estate tax exemption sunset date

1 2026 the estate tax exemption is set to drop back to what it was before 2018. Notably the TCJA provision that doubled the gift.

Insights Blog Intrust Advisors

The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added.

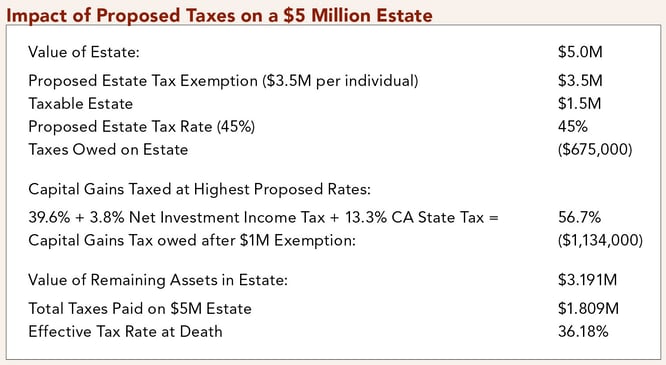

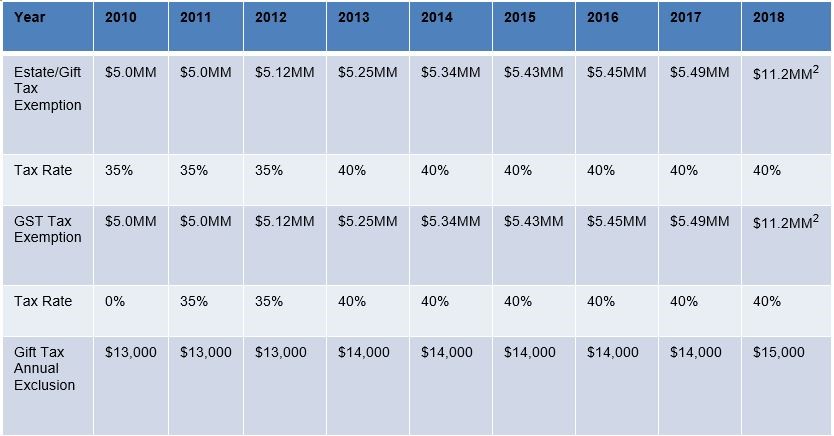

. January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. Sailing Into the Sunset. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

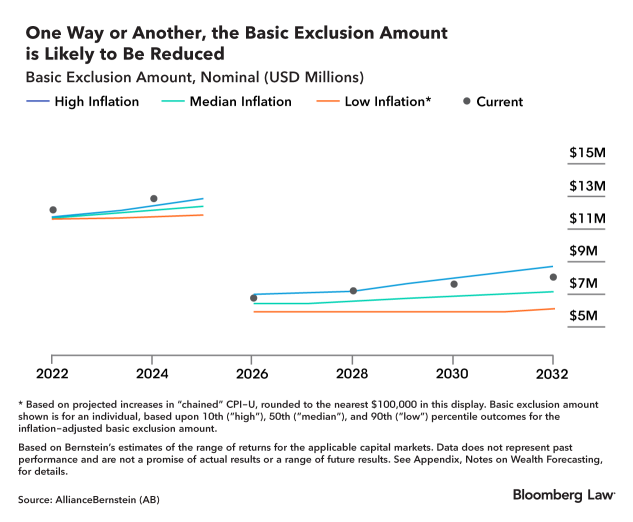

Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. Your estate wouldnt be. 5 million adjusted for inflation.

Effective January 1 2022 no Ohio estate tax is. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. Federal Estate Tax Exemption Sunset Date The Federal Estate Tax Exemption Sunset is scheduled for 2026 unless it is extended by congress.

The Unified Gift and Estate Tax Lifetime Exemption Set to Sunset and Revert to Pre-Tax Cuts and Jobs Act Levels in 2026 Says Otherwise. Select the county from. Projections for the post-sunset.

Start the discussion by working with your client by exploring how and how much to give in the event that the GST tax exemption expires earlier than the current sundown date of. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. Localities have the further option of giving sliding scale exemptions of less than 50 percent to persons with.

Projections for the post-sunset. The current estate and gift tax exemption is scheduled to end on the last day of 2025. Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president.

While home values rise by an average of 15000 with a solar energy system city county and school district taxes will not reflect that. The 2022 exemption is 1206 million up from 117 million in 2021. Federal Estate Tax Exemption 2023.

After 2025 the exemption amount will sunset a fancy way of. The first 1206 million of your estate is therefore exempt from taxation. However the TCJA will sunset.

After that the exemption amount will drop back down to the prior laws 5 million cap. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. Find your local assessment roll municipalities outside of New York City Visit the Municipal Profiles application.

The current 1206 million estate tax. In this case on Jan. Ohio Estate Tax Sunset Provision 2021.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The income limit may be as low as 3000 and as high as 50000. This exemption is excellent news for homeowners.

Select Search for a City Town or Village. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. With respect to the 100 Totally and Permanently Disabled Veterans Property Tax Exemption it can begin after December 3 2020 assuming all other eligibility requirements are met.

A New Era In Death And Estate Taxes

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Four More Years For The Heightened Gift And Tax Estate Exclusion

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

The Incredible Shrinking Estate Tax Tax Policy Center

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

Creating Estate Tax Plans Under The Biden Administration

2020 Estate And Gift Tax Update Lbmc Wealth Management

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax In The United States Wikipedia

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Portability Of The Estate Tax Exemption How It Works

Exploring The Estate Tax Part 2 Journal Of Accountancy

Four More Years For The Heightened Gift And Tax Estate Exclusion